Howden’s renewal report at 1.1.2022: Times are a-changin’

Published

Read time

Shifting views of risk replace capacity as the pre-eminent driver of renewals

4thJanuary 2022, London – Howden, the international insurance broker, today releases its annual report on the risk transfer market and 1 January 2022 reinsurance renewals. The theme of change is pervasive throughout: the mix of heightened secondary catastrophe perils, rising core inflation, temporarily subdued social inflation and a dislocated cyber market have reset the risk landscape, adding a large dose of complexity to an already complicated underwriting environment.

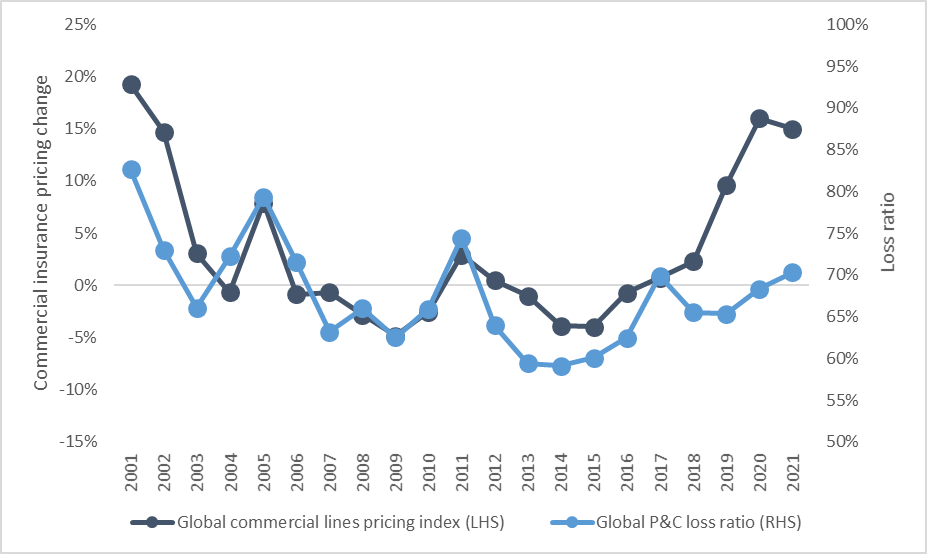

Despite successive years of rate rises, carriers continue to deploy capacity cautiously. The result for global commercial insurance was a premium-weighted rate rise of 12% in 2021, with some moderation in most business lines throughout the year. Rate expectations heading into 2022 are balanced between a highly fluid risk landscape on the one hand, and strong underwriting results on the other (as shown in Figure 1). Carrier margin improvements could help offset pressure to raise rates in 2022 with insurance buyers now four years into higher prices.

Figure 1: Annualised global P&C rate change vs loss ratio – 2001 to 9M211 (Source: NOVA)

2022 reinsurance renewals

Reinsurance renewal outcomes at 1 January 2022 were shaped against this backdrop. Changing inflationary and loss trends had a tangible effect on supply and demand dynamics in more challenged areas, with some buyers seeking to secure additional coverage in response to increasing exposure assumptions. Capital providers’ appetite was meanwhile moderated by requirements around structure, terms and price, in addition to a desire to control volatility.

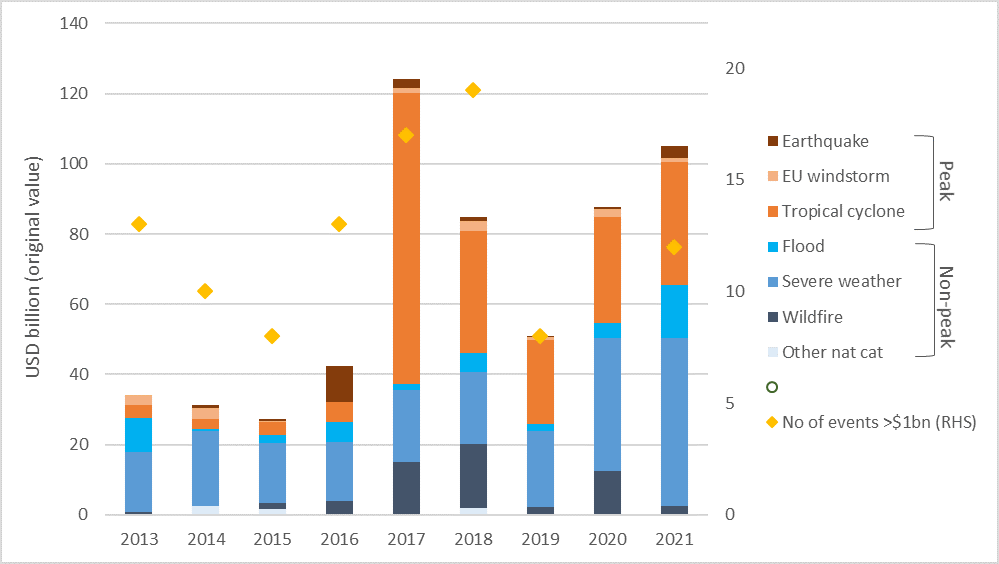

After a year of more than USD 100 billion insured catastrophe losses, a figure breached in real terms for only the fourth time on record, climate change and the rise of so-called secondary or non-peak perils (as shown in Figure 2) were recurring themes during property reinsurance renewals. The prevalence of such events in 2021 – including winter storm Uri, the European floods and the tornado outbreak in the U.S. late in the year – reinforced carriers’ concerns around price adequacy and catastrophe model efficacy. With the increased volatility of secondary events more closely associated with climate change, this will be an area of continued market focus and action in 2022.

Figure 2: Global insured natural catastrophe losses by peril – 2013 to 20212

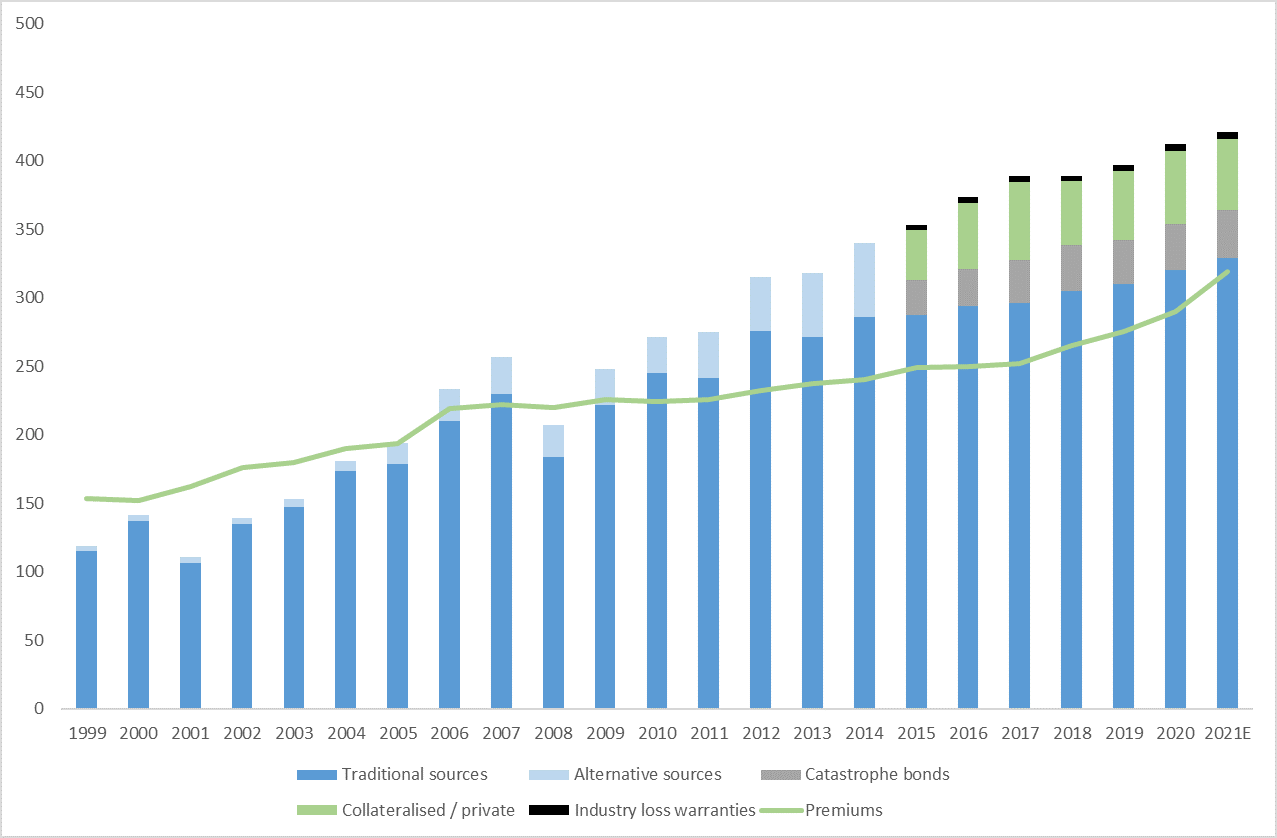

Strong capitalisation and abundant capacity helped to cap the degree of firming. Figure 3 shows dedicated reinsurance capital rose to the record level of USD 421 billion at YE2021, led by record catastrophe bond issuance as well as continued growth in traditional capital. This was offset marginally by a sizeable portion of trapped capital in the collateralised market, where investor fatigue from the five-year run of sizeable losses prevented reloading on the scale seen in previous years.

Figure 3: Dedicated reinsurance capital and global gross reinsurance premiums (all classes) – 1999 to 20213

Other key outcomes from 1 January 2022 renewals included:

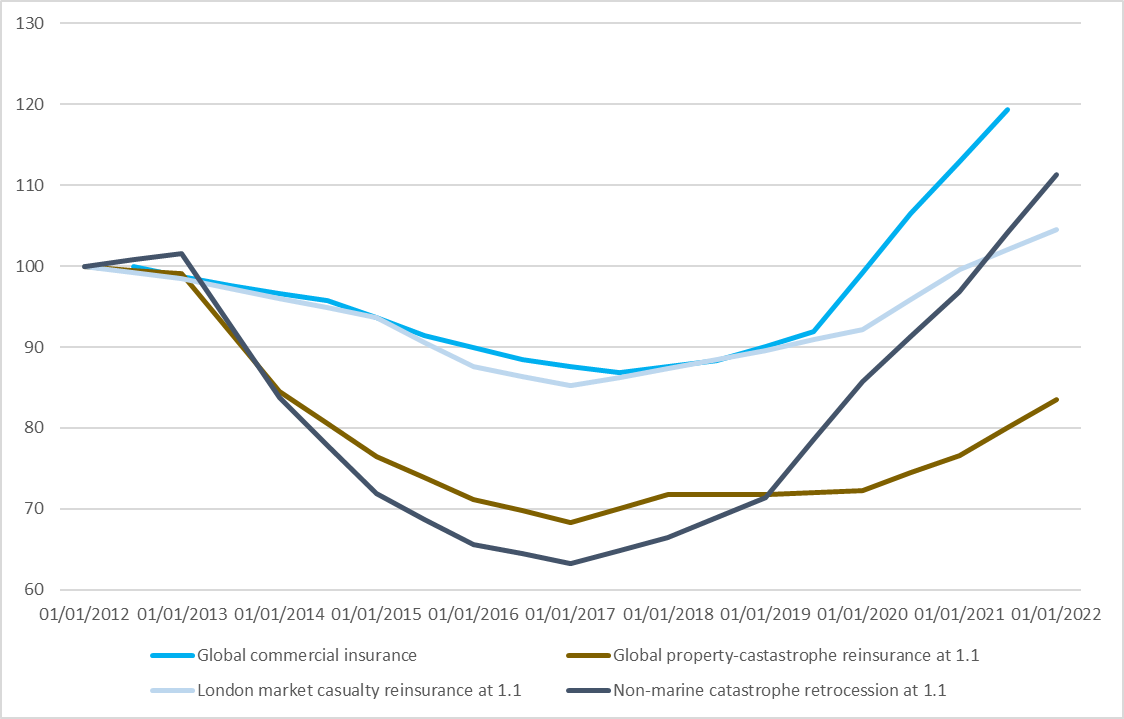

Retrocession: Trapped ILS capital and another year of large loss events created a difficult retrocession renewal. Risk-adjusted retrocession catastrophe excess-of-loss rates-on-line rose by 15% on average. Climate change and the attendant issue of catastrophe model efficacy were decisive factors this year, with the unusual mix of secondary events fuelling sentiment that changing weather patterns are now increasing both the frequency and severity of climate-sensitive perils.

Global property-catastrophe: Howden’s Global Property-Catastrophe Risk-Adjusted Rate-on-Line Index rose by 9% at 1 January 2022. This was higher than the 6% recorded last year, and the biggest year-on-year increase since 2009, taking the index back to pricing levels last recorded in 2014. Given the higher weighting of European programmes up for renewal at 1 January, loss experience in the region was a key inflating factor.

Casualty reinsurance: Ample capacity, fed by higher rates and improved profitability on original business, provided a more constructive backdrop for casualty reinsurance renewals. Strong competition prevailed over any threat posed by inflation (social or economic) in what remains a historically low interest rate environment. High levels of competition for profitable proportional business, combined with cedents’ willingness to retain more net exposure, pushed up ceding commissions across multiple accounts. As a result, London market casualty reinsurance rates-on-line, including adjustments for exposure changes and ceding commissions, rose by 5% on average.

Figure 4: Howden pricing index for primary, reinsurance and retrocession markets – 2012 to 20224

Looking ahead to 2022

The insurance macro-fundamental environment is clearly shifting. A series of megatrends – higher inflation, lacklustre investment yields, elevated catastrophe loss activity, climate change, new cyber threats and heightened risk aversion – are making the landscape more challenging to predict. However, healthy capitalisation – USD 26 billion of new capital entered the market in 2020/21 – puts the sector is in a strong position to tackle these changes.

David Flandro, Head of Analytics said: “A host of factors contributed to unusually late renewals this year, with 11th hour secondary perils complicating the process further. The market is faced with known unknowns like climate change, inflation and lingering COVID concerns, all of which are creating uncertainty.”

Nevertheless, with insurance capital currently at record levels, and premiums rising on the back of higher pricing and heightened risk awareness, this remains a resilient and well-capitalised marketplace that can manage these challenges.”

José Manuel González, CEO, Howden Broking added: “Irrespective of market cycles, clients expect the insurance sector to innovate, to develop creative solutions and to offer sufficient capacity during what is one of the most significant periods of change in living memory.”

“We see climate risk as one of the primary concerns for (re)insurance in this decade. Insurers must be prepared to re-evaluate climate-related risks proactively, and to provide a level of flexibility in underwriting solutions in order to maintain coverage ability whilst also creating new and innovative products. This will be no easy feat, and insurance will be a critical component in driving the mitigation and adaptation needed to confront climate change risks and deliver long-term profitability.”

“At Howden, our responsibility as a trusted adviser is to bring important sector trends to the fore, to lead the discussion and to facilitate the most innovative client solutions. We look forward to working closely with insurance and reinsurance companies in this endeavour, and to supporting clients in managing change and securing the best coverage available in the marketplace.”